Millions of Americans are about to get what amounts to a pay raise. Starting next month, and continuing through the end of this year, a new stimulus check will arrive like clockwork, generally on the 15th of every month — which, of course, is already payday for millions of workers. In this case, though, the pay raise that millions of families are about to get is actually the first tranche of what will be an expanded federal child tax credit of up to $3,600 for each eligible child, which will work out to as much as $250 or $300 per month, per eligible child, from July 15 until the end of this year.

On that date next month, the first wave of these payments is set to begin. Here’s everything you need to know about them, including what they are and who’s eligible to receive them.

First of all, it’s important to note that these new stimulus payments that are about to start showing up in mailboxes and in bank accounts as direct deposits are very distinct from the more than 169 million stimulus checks that have gone out since March of this year. Those were one-and-done payments, funded by the $1.9 trillion stimulus legislation that President Biden signed in March.

That legislation, though, also funded a completely separate benefit — an expansion of the federal child tax credit, which will pay families up to $3,600 (multiplied by however many eligible children they have), a dollar amount that’s also essentially being sliced up into monthly checks. That ends up making this payment much more beneficial to families than one solitary check from the federal government.

Something else that’s also important to point out: Don’t get confused by all the chatter, rumors, and speculative news stories about the possibility of a fourth stimulus check. As a reminder, there have been three proper coronavirus stimulus checks up to this point, which includes two from the Trump administration last year and one (for generally $1,400) from the Biden administration. A fourth wave of stimulus checks may or may not get approved down the line, but that has nothing to do with the monthly payments that are set to begin on July 15. Those forthcoming payments have already been funded, and, in fact, the IRS has started sending out the first of two letters in the mail to eligible recipients.

China may have snapped the greatest Mars selfie ever

More than 36 million families are getting these letters, the first of which will confirm eligibility, while the second will be more personalized and let the recipient know how big of a federal child tax credit to expect.

Insane Things That You Will Only Find In Dubai

Additional facts to know:

- The IRS estimates these federal child tax credit payments will go out to some 39 million households, which include about 88% of children in the US.

- By the IRS’ figures, households covering more than 65 million children “will receive the monthly CTC payments through direct deposit, paper check, or debit cards, and IRS and Treasury are committed to maximizing the use of direct deposit to ensure fast and secure delivery,” according to an announcement from the tax agency. It continues: “While most taxpayers will not be required to take any action to receive their payments, Treasury and the IRS will continue outreach efforts with partner organizations over the coming months to make more families aware of their eligibility.”

- It’s also important to note that these child tax credit payments will be made on the 15th of each month, except for the month of August (the 15th falls on a Sunday that month, so Friday the 13th will be the payment date). Eligible families will receive a payment of up to $300 per month for each child under age 6 and up to $250 per month for each child between age 6 and 17.

Trump administration offers to pay plane tickets, give stipend to self-deporting immigrants

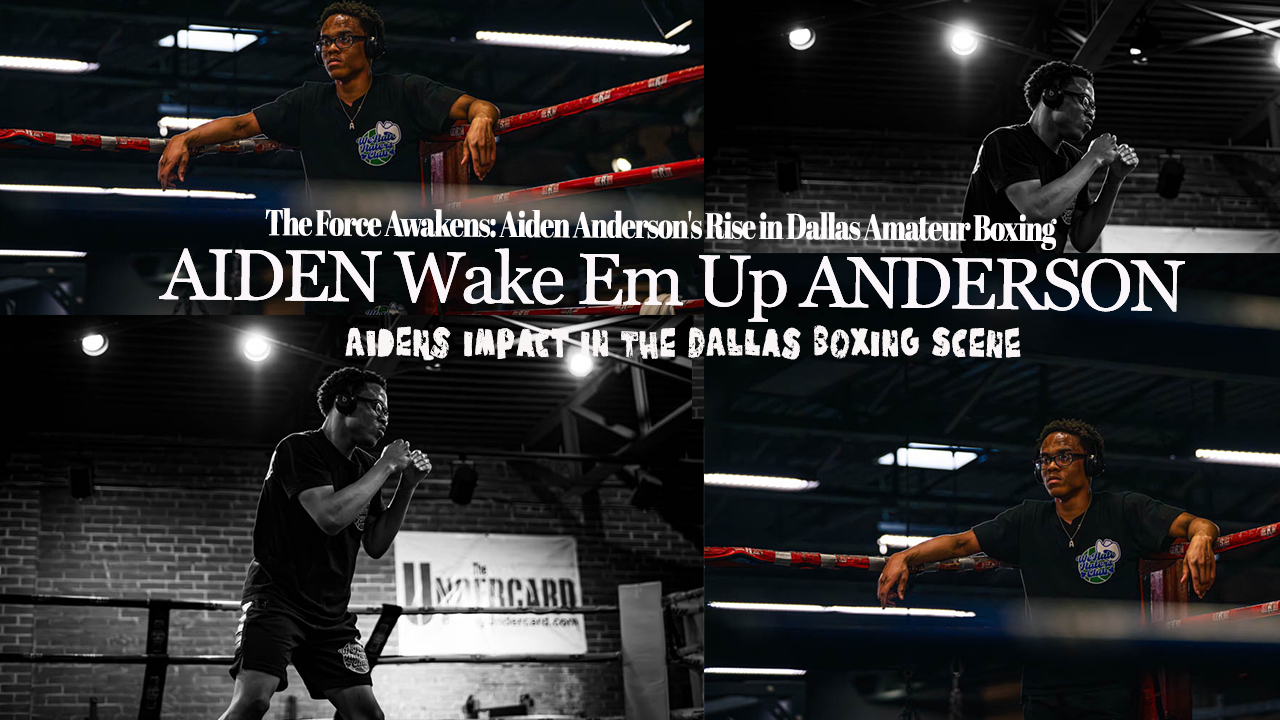

Trump administration offers to pay plane tickets, give stipend to self-deporting immigrants  The Force Awakens: Aiden Anderson’s Rise in Dallas Amateur Boxing

The Force Awakens: Aiden Anderson’s Rise in Dallas Amateur Boxing  Tesla’s Cybertruck Will Rapidly Depreciate From Now On

Tesla’s Cybertruck Will Rapidly Depreciate From Now On  Was it really about the Lil Wayne Concert

Was it really about the Lil Wayne Concert  Black Chicago Activists Blast Mayor Brandon Johnson for “Replacing” Them With Migrants

Black Chicago Activists Blast Mayor Brandon Johnson for “Replacing” Them With Migrants  Migrants desperately digging through trash bins for food as they live out of buses in Chicago

Migrants desperately digging through trash bins for food as they live out of buses in Chicago  Sofia Llamas: A Force for Good in Colorado – Igniting Hope and Empowering Communities

Sofia Llamas: A Force for Good in Colorado – Igniting Hope and Empowering Communities  Thomas Edward Patrick Brady Jr, Shedeur Sanders, Travis Hunter, Shilo Sanders, Jimmy Horn Jr, Global Don, and more

Thomas Edward Patrick Brady Jr, Shedeur Sanders, Travis Hunter, Shilo Sanders, Jimmy Horn Jr, Global Don, and more